ES Daily Plan | March 13, 2023

The daily is one time framing down following Friday’s downside continuation. Sellers main objective is to build value/acceptance at these lower prices to prevent the attraction of responsive activity.

Contextual Analysis

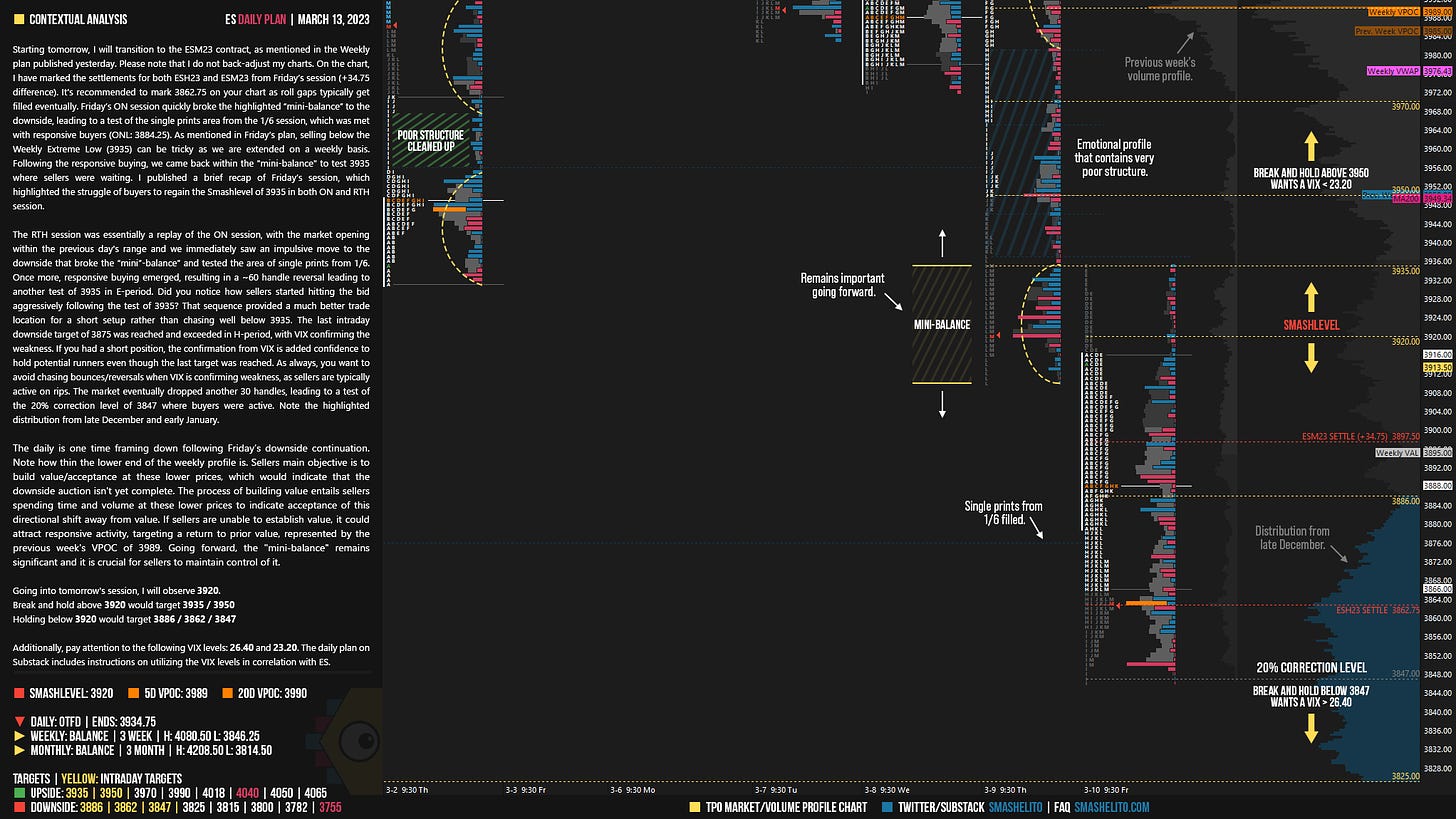

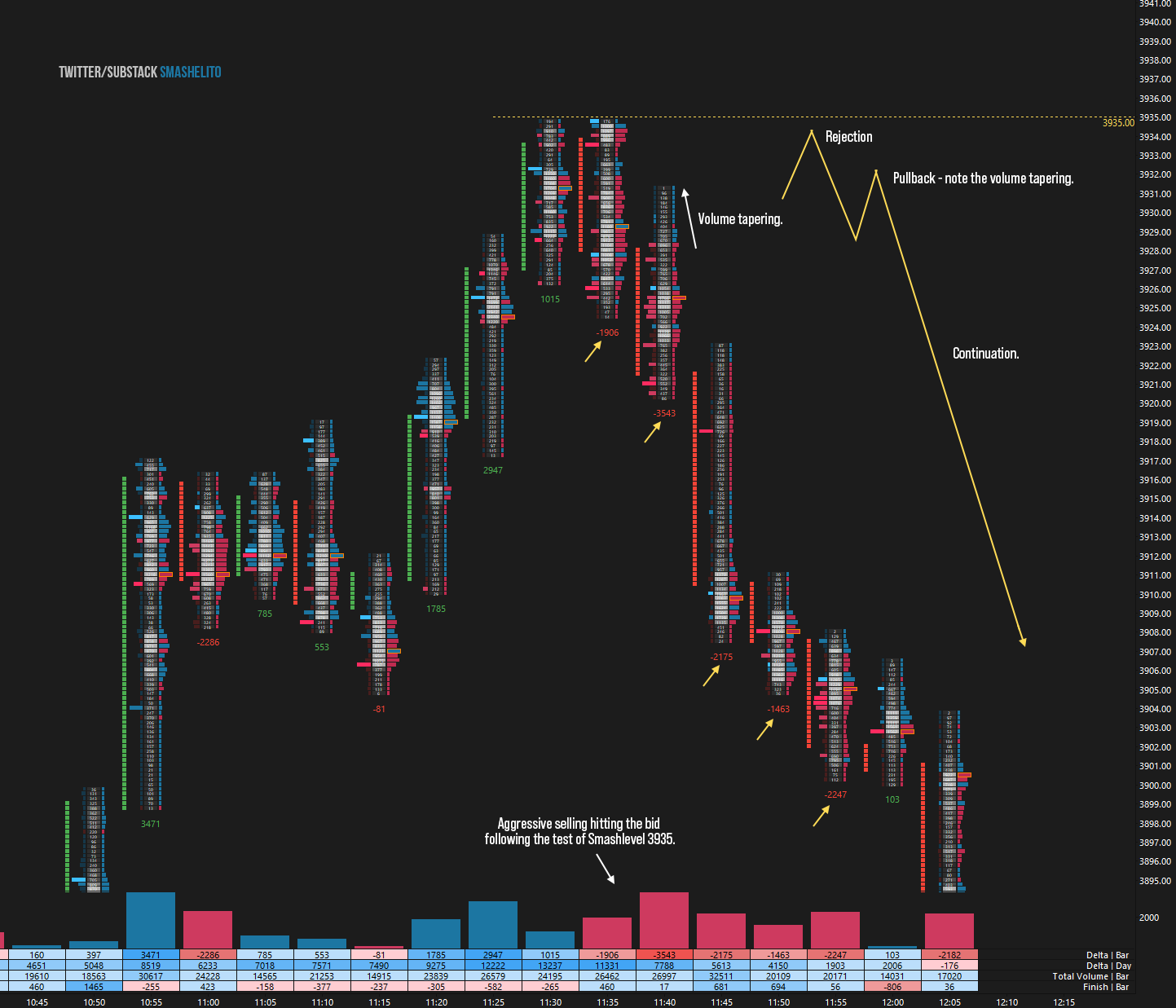

Starting tomorrow, I will transition to the ESM23 contract, as mentioned in the Weekly plan published yesterday. Please note that I do not back-adjust my charts. On the chart, I have marked the settlements for both ESH23 and ESM23 from Friday’s session (+34.75 difference). It's recommended to mark 3862.75 on your chart as roll gaps typically get filled eventually. Friday’s ON session quickly broke the highlighted “mini-balance” to the downside, leading to a test of the single prints area from the 1/6 session, which was met with responsive buyers (ONL: 3884.25). As mentioned in Friday’s plan, selling below the Weekly Extreme Low (3935) can be tricky as we are extended on a weekly basis. Following the responsive buying, we came back within the "mini-balance" to test 3935 where sellers were waiting. I published a brief recap of Friday’s session, which highlighted the struggle of buyers to regain the Smashlevel of 3935 in both ON and RTH session.

The RTH session was essentially a replay of the ON session, with the market opening within the previous day's range and we immediately saw an impulsive move to the downside that broke the “mini”-balance” and tested the area of single prints from 1/6. Once more, responsive buying emerged, resulting in a ~60 handle reversal leading to another test of 3935 in E-period. Did you notice how sellers started hitting the bid aggressively following the test of 3935? That sequence provided a much better trade location for a short setup rather than chasing well below 3935.

The last intraday downside target of 3875 was reached and exceeded in H-period, with VIX confirming the weakness. If you had a short position, the confirmation from VIX is added confidence to hold potential runners even though the last target was reached. As always, you want to avoid chasing bounces/reversals when VIX is confirming weakness, as sellers are typically active on rips. The market eventually dropped another 30 handles, leading to a test of the 20% correction level of 3847 where buyers were active. Note the highlighted distribution from late December and early January.

The daily is one time framing down following Friday’s downside continuation. Note how thin the lower end of the weekly profile is. Sellers main objective is to build value/acceptance at these lower prices, which would indicate that the downside auction isn't yet complete. The process of building value entails sellers spending time and volume at these lower prices to indicate acceptance of this directional shift away from value. If sellers are unable to establish value, it could attract responsive activity, targeting a return to prior value, represented by the previous week's VPOC of 3989. Going forward, the "mini-balance" remains significant and it is crucial for sellers to maintain control of it.

Going into tomorrow's session, I will observe 3920.

Break and hold above 3920 would target 3935 / 3950

Holding below 3920 would target 3886 / 3862 / 3847

Additionally, pay attention to the following VIX levels: 26.40 and 23.20. These levels can provide confirmation of strength or weakness.

Break and hold above 3950 with VIX below 23.20 would confirm strength.

Break and hold below 3847 with VIX above 26.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Hi, i am new subscriber here and read through articles over past week.. Kudos to your analysis and accuracy. When you say the "level you will be observing" is it during RTH or before, as i see these levels are already tested/visited much before RTH. Thanks and keep it up.

Fantastic!